Market Recap

An extremely difficult year in the financial markets ended with a thud for U.S. stocks. After a 14% rally in October and November, the S&P 500 Index dropped 5.8% in December to close out the year with an 18.1% loss, its largest annual decline since 2008.

Foreign stock markets held up much better in the fourth quarter. Developed international stocks (MSCI EAFE Index) gained 17.3% — one of their best quarters ever — and Emerging Market stocks (MSCI EM Index) were up 9.7 %. For the full year, developed international stocks were down 14.5% in dollar terms (almost four percentage points better than the S&P 500), while EM stocks were down a bit more than the S&P 500 with a 20.1% drop. These annual returns were despite the U.S. dollar (DXY Index) appreciating 8.3% for the year, which reduces dollar-based foreign equity returns one-for-one. In the fourth quarter, however, the dollar dropped 7.7%, providing a tailwind to EM and international equity returns for U.S. investors.

Turning to the fixed-income markets, core investment-grade bonds (Bloomberg U.S. Aggregate Bond Index, aka the “Agg”) had a solid fourth quarter, gaining 1.9%. But this was still the worst year for core bonds in at least 95 years, with the Agg dropping 13.0%. The key driver, of course, was the sharp rise in bond yields; the 10-year Treasury yield ended the year at 3.9%, up from just 1.5% a year prior. High-yield bonds (ICE BofA Merrill Lynch U.S. High Yield Index) had a strong fourth quarter, up 4.0%, but were down 11.2% for the year. Floating rate loans (Morningstar LSTA Leveraged Loan index) were the best segment within the bond markets, down less than 1% for the year. Municipal Bonds were down 8% (Morningstar National Muni Bond Category).

Alternative strategies and nontraditional asset classes generally outperformed traditional stock and bond indexes. The standout was trend-following managed futures strategies, which gained roughly 27% (SG Trend Index) for the year. Flexible/nontraditional bond funds (Morningstar Nontraditional Bond category) declined 6.3%, roughly half as much as core bonds.

Portfolio Performance and Key Performance Drivers

For 2022, portfolios generally out-performed relative to their benchmarks (their respective S&P Target Risk Index). Portfolios didn’t avoid losses, but losses were mitigated.

Positive contributors included my tactical positions in flexible, actively managed bond funds, short-term inflation protected funds and floating-rate loan funds, which declined much less than the core bond index. My tactical allocation to trend following managed futures funds significantly outperformed core bonds and stocks and added beneficial portfolio diversification as well the other alternative investment strategies that employ. My tilt towards value stocks tempered losses as well.

Investment Outlook and Portfolio Positioning

Inflation and monetary policy remain the financial markets’ key macro focus. U.S. headline inflation data have improved, suggesting we’ve seen the peak in inflation for this cycle. Various measures of core inflation (i.e., excluding food and energy) have flattened, but remain at 5% or 6%, far above the Federal Reserve’s 2% target. The Fed’s message has been clear that it intends to maintain restrictive (tight) monetary policy throughout 2023. Indeed, at its December 14 meeting, the Fed raised the fed funds rate by 0.5% to a target range of 4.25% to 4.50%. It also forecasted 75bps of additional rate hikes in 2023.

Inflation is not just a U.S. problem. Nearly all the other major global central banks (except Japan and China) are also continuing to hike interest rates in their countries. For example, both the European Central Bank (ECB) and the Bank of England hiked their policy rates another 0.5% in December. These synchronized global rate hikes will further depress global aggregate demand and economic growth over the shorter term. It’s also typically a headwind for stocks.

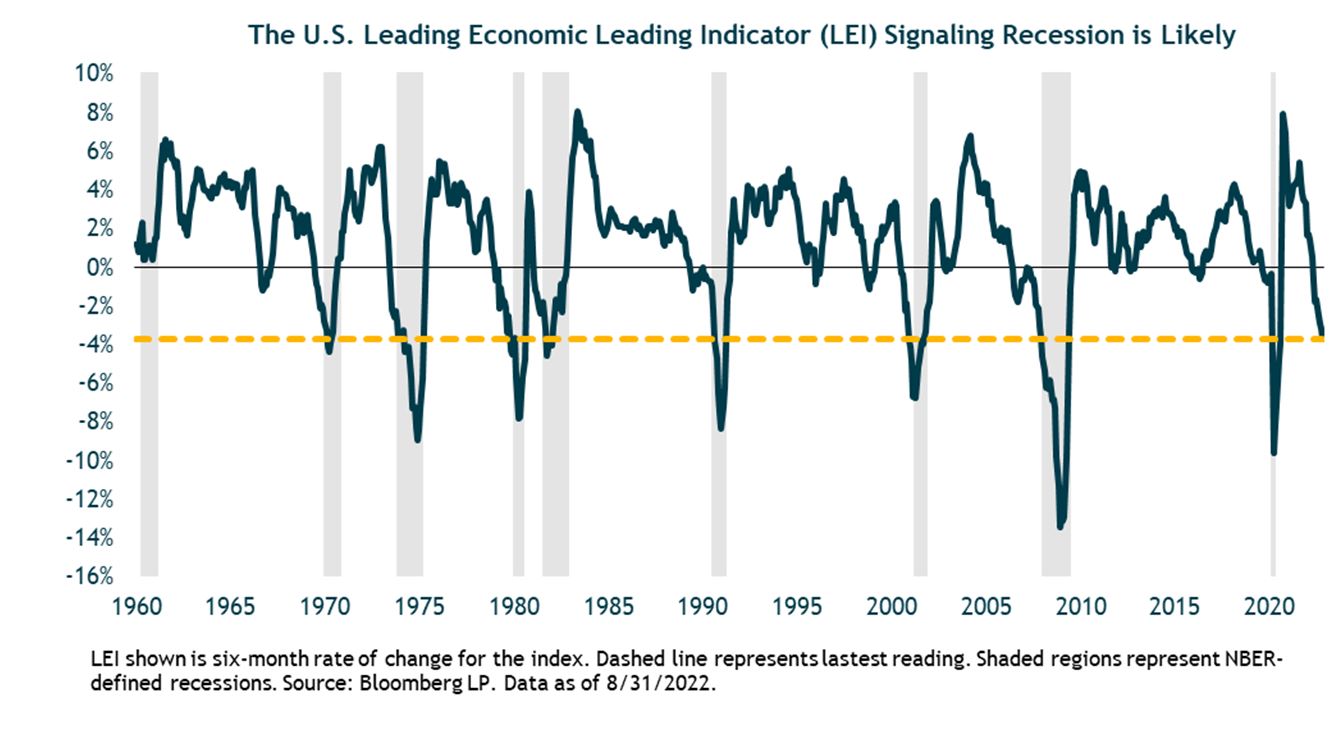

On the economic growth front, key leading indicators deteriorated further in the fourth quarter. The Leading Economic Indicator (below), which has a long track record of “calling” recessions, has fallen for nine consecutive months (and likely will again in December). This has never happened without an ensuing recession.

While I weigh the evidence as leaning strongly towards recession, there are some positives supporting the economy that should mitigate the severity of a U.S. recession if and when it happens. First and foremost, the labor market remains strong, enabling consumer income and spending growth; monthly job growth (nonfarm payrolls) has also remained solid, increasing by 263,000 in November; weekly new unemployment claims (a leading indicator for the labor market) remain low, though they are ticking higher.

Households also still have huge “excess savings” stemming from the pandemic – about $1.5 trillion (down from $2.3 trillion) that can support additional spending even as the Fed tightens. Business balance sheets are also generally in good shape, with many firms having refinanced their debt at low rates prior to this year’s sharp rise. More broadly, there don’t appear to be any major, systemic, economic/financial icebergs lurking under the surface, e.g., unlike in 2007-08 with the housing/mortgage derivatives market.

To the above list of macro positives, I’d add a significant new development in the fourth quarter: the unexpected and sudden abandonment of China’s highly restrictive zero-COVID policy. Zero-COVID has been the key driver of China’s economic slump the past two years. But now the most repressive measures – mandatory testing, quarantines, community lockdowns and travel restrictions – are being revoked. The reopening of China’s economy for domestic consumers should be a catalyst for a growth rebound in 2023.

The bottom line is that a U.S. recession this year is not a certainty. But based on the evidence, I think it is highly likely. On the positive side, it should be milder than the 2007-08 and 2000-01 recessions.

At present, I believe the current price of U.S. Stocks (S&P 500 index) do not adequately discount the likelihood and severity of an economic and corporate earnings recession. This was my view one quarter ago, and since that time the S&P 500 has climbed a few percent while the economic data has worsened. My analysis of past data on recessions, earnings declines and stock valuations suggest a real possibility of further double-digit declines in the S&P 500 from current levels.

Foreign stock markets and earnings are also at-risk from a U.S. and global recession next year. However, unlike the S&P 500, my five-year base case expected return estimates for developed international and EM stocks are reasonably attractive in absolute terms, ranging from the mid-single digits to the low-double digits, with EM the highest. (See the table below.) These returns are even more attractive relative to U.S. stocks and core bonds.

Between the three regions, I tactically favor EM stocks right now based on their higher expected returns, which are a function of what I expect will be faster sales growth and improving profit margins over the next several years. This comes after more than 10 years of stagnant EM earnings growth. Monetary policy is also likely to start loosening next year across many EMs as inflation comes down, which should be another support for EM equity markets.

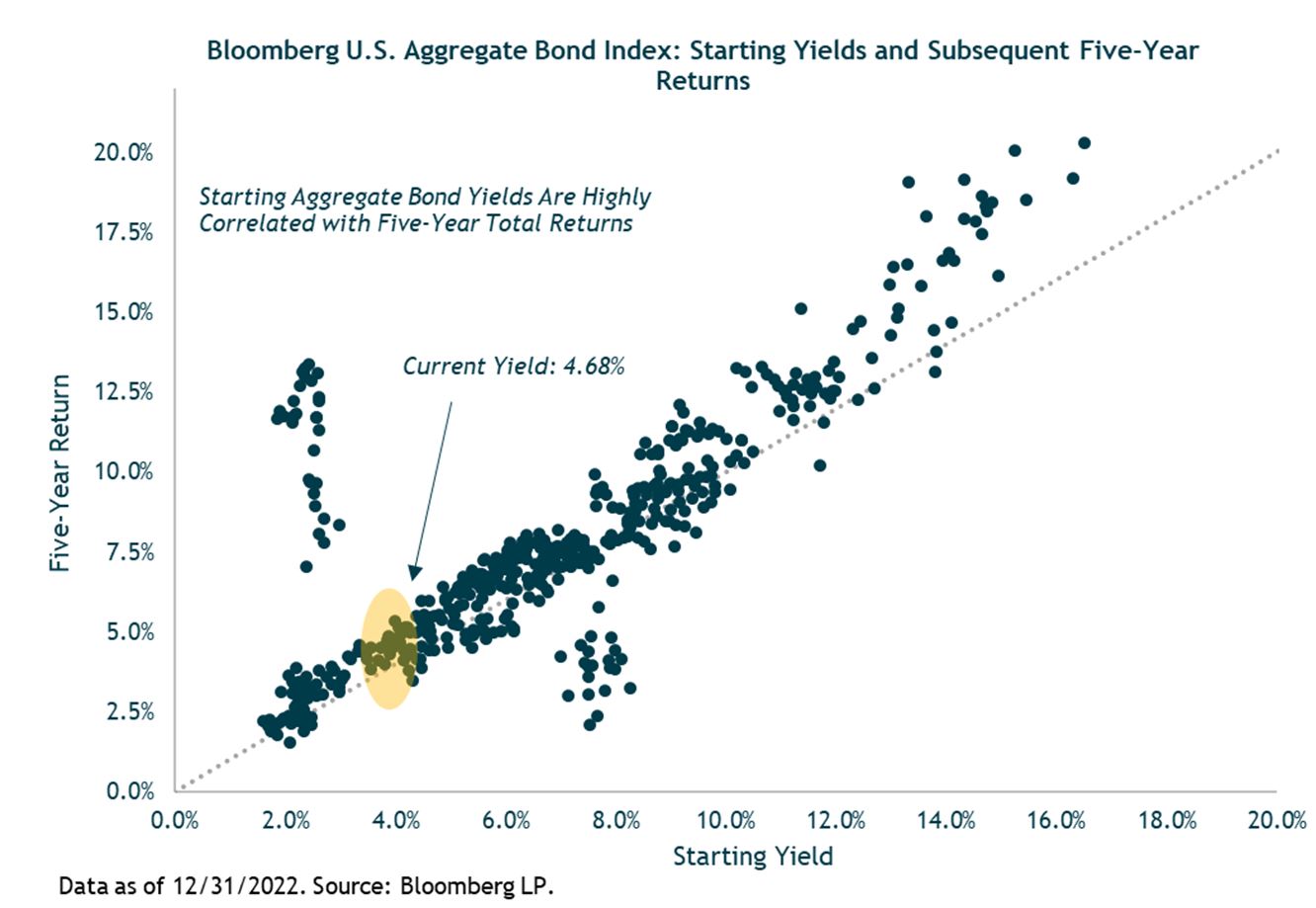

Turning to my outlook for fixed income, given the sharp rise in yields, bonds haven’t been this attractive in over a decade. When estimating returns for core bonds (the Agg) over longer periods of time, the starting yield is a good approximation of subsequent returns (see chart below). At year-end, the Agg was yielding 4.7% and my 5-year expected return for core bonds is now in a range of 5% to 5.6%. Moreover, I expect core bonds to deliver a positive return if a recession plays out, providing valuable downside protection while riskier assets such as stocks get hit.

Finally, I maintain core positions in trend-following managed futures funds and other alternative strategies. Managed futures returns have been strongly positive this year as traditional bond and stock funds have plunged. These alternative funds have different return and risk drivers, and I believe will continue to provide tactical and longer-term strategic benefits to balanced portfolios. They are much less dependent than traditional investments on which type of macro environment (e.g., deflation, stagflation, inflation, or growth) unfolds over the coming years.

Closing Thoughts

As 2022 has reminded investors, we should “expect the unexpected, and expect to be surprised.” This is expressed in my portfolio construction and investment management via balanced risk exposures, diversification and forward-looking analysis that considers a wide range of potential scenarios and outcomes.

I believe 2023 will likely present some excellent long-term investment opportunities. Unfortunately, I also expect a recession and the potential for stock market volatility.

While challenging, it is critical for long-term investors to stay the course through these rough periods. The shorter-term discomfort is the price one pays to earn the long-term “equity risk premium” – the additional return from owning riskier assets such as stocks that most investors need to build long-term wealth and achieve their financial objectives.

Outside of the U.S. stock market, I already see attractive medium-term expected returns from international and emerging markets stocks. (With a recession they will likely get more attractive.) A declining dollar, as I expect medium-term, would further fuel non-U.S. equity returns.

Fixed-income assets and high-quality bonds are also now reasonably priced with mid-single digit or better expected returns. Core bonds will also provide valuable portfolio ballast in the event of a 2023 recession. Investments in alternative strategies and managed futures funds provide further resilience to our portfolios no matter how the next year (and years) play out.

I wish you and yours a healthy, happy, and prosperous New Year.

— Jeff – 1/10/23

Certain material in this work is proprietary to and copyrighted by iM Global Partner Fund Management, LLC and is used by Bogue Asset Management LLC with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.