Market Recap

In the first three months of 2024, the U.S. economy remained resilient despite short-term interest rates sitting near 20-year highs. Noteworthy in the quarter was the continuing robustness in the labor market, stronger-than-anticipated corporate earnings, and a convergence of market participants’ aggressive forecast of rate cuts with the Fed’s own projections. Retail sales pulled back, but the trend remains positive.

These factors provided a supportive backdrop for stocks. The S&P 500 Index continued to reach new highs throughout the quarter, gaining 10.6% in the three-month period. Large-cap U.S. stocks (S&P 500 Index) outperformed small-cap U.S. stocks (Russell 2000 Index), and growth stocks (Russell 1000 Growth) again beat value stocks (Russell 1000 Value).

Developed International and emerging-market stocks also posted gains but did not keep pace with the U.S. market. Developed International stocks (MSCI EAFE) gained 5.8%, while emerging-market stocks (MSCI EM Index) posted a 2.4% return.

Bond returns were mixed as the benchmark 10-year Treasury yield rose from 3.88% to 4.20%, with market expectations for rate cuts tempered in terms of timing and magnitude. In this rising-yield environment, the more interest-rate sensitive Bloomberg U.S. Aggregate Bond Index declined 0.8%. Credit performed relatively well in the quarter, as high-yield bonds (ICE BofA High Yield Index) were up nearly 1.5%.

Turning to Alternatives, Managed Futures (SG Trend Index) had a strong first quarter, gaining 12.2%, keeping pace with the S&P 500 Index (+10.6%) and handily beating the Bloomberg Aggregate Bond Index (-0.8%). This is a reminder that managed futures strategies aren’t just negatively correlated to the stock and bond markets but can also produce attractive returns across different market environments.

Investment Outlook and Portfolio Positioning

The U.S. economy has continued to prove resilient despite the Fed maintaining a higher level of interest rates for longer than most expected. A main driver of this better-than-expected economic growth has been the continued strength of the U.S. consumer. The combination of robust job gains and steady real income growth has allowed consumers to continue spending despite higher rates. The strong consumer has also benefited corporate earnings. And after a decade of near-zero interest rates, companies are generally well positioned financially with balance sheets that are healthier than they have been in past tightening cycles.

Inflation (CPI) has declined meaningfully over the past year, falling from 6% to just over 3%, though still above the Fed’s long-term target of 2%. My expectation is that inflation will continue to trend lower over time, due in large part to shelter costs, which I expect to moderate.

Source: Bloomberg. Data as of 3/31/2024.

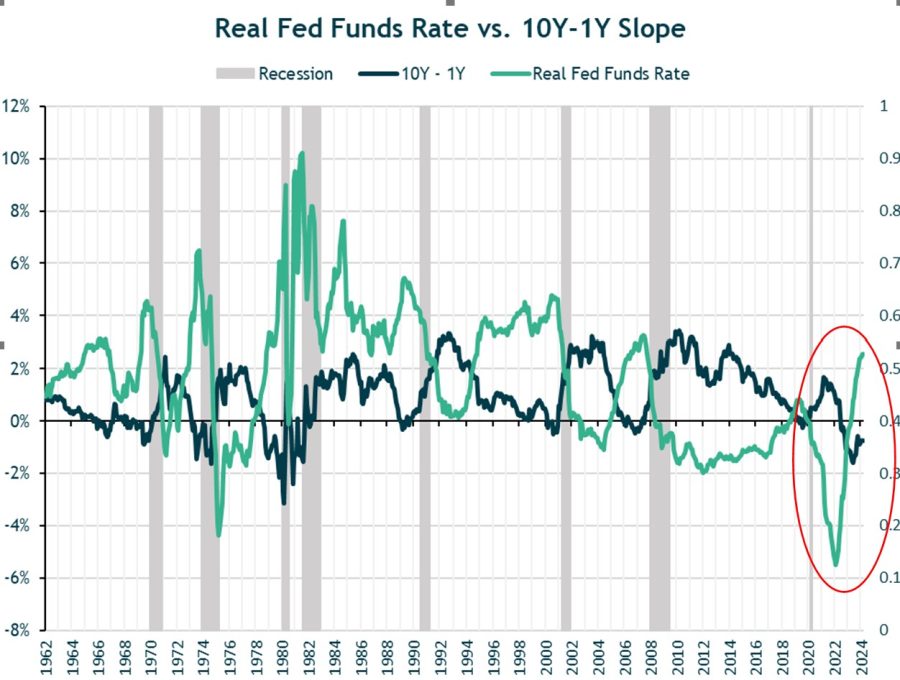

With the steady decline in inflation, I believe Fed policy has crept into borderline restrictive territory. The chart above shows the Yield Curve (10-year minus 1-year maturity, blue line), alongside the real fed funds rate (i.e., fed funds rate net of inflation, green line). Going back to 1960, an inverted curve combined with a sharply higher real fed funds rate has preceded a recession (gray bar). In the most recent cycle, however, we can see that while the yield curve has been inverted since July 2022, Fed policy has been very accommodative for most of that time, i.e., the real Fed Funds rates were sharply negative when the curve first inverted. It’s only more recently that Fed policy has started to move toward restrictive levels due to the combination of a higher fed funds rate and falling inflation. Simply put – to the extent that inflation continues to fall, and the Fed keeps rates unchanged, monetary policy will become proportionately more restrictive, and could reach a level that significantly slows the economy.

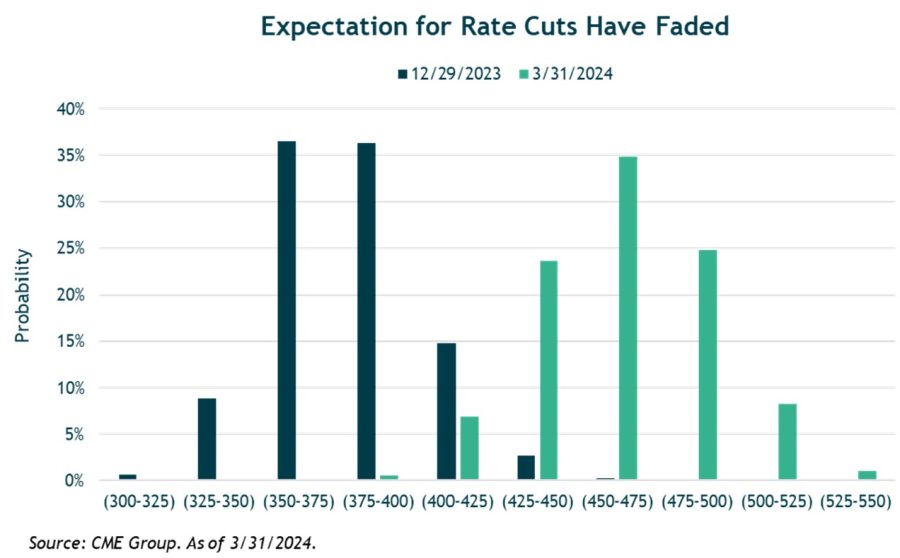

Economic growth in and of itself does not cause inflation, and ongoing modest economic growth is not a reason for the Fed to avoid cutting rates. However, persistent growth of around 2% does make it difficult to foresee aggressive rate cuts, and I’ve seen this reflected in the market’s expectations for the Fed Funds rate during the quarter. In the chart above, we see that at the beginning of the year, the market was anticipating six to seven rate cuts (shown in blue). But as of the end of March, the market’s expectations (show in green) have tempered, and the consensus is for three rate cuts bringing the top end of the Fed Funds range to 4.75% at the end of 2024.

I am currently in line with consensus expectations that the Fed will cut by 25bps in June, with two more cuts later in the year. With inflation still running slightly hot the Fed has to balance cutting too early and potentially causing a second wave of inflation, versus waiting too long and putting pressure on the consumer and the economy. What the Fed ultimately decides will depend on the economic data that unfolds.

For now, U.S. economic data seems supportive of growth, not contraction. If the Fed is able to engineer a ‘soft landing’ of the U.S. economy with inflation converging to 2% and growth continuing, they can incrementally lower rates and ensure that policy does not become too restrictive. If a recession does occur later this year, the Fed will have the ability to swiftly and meaningfully cut rates given current levels.

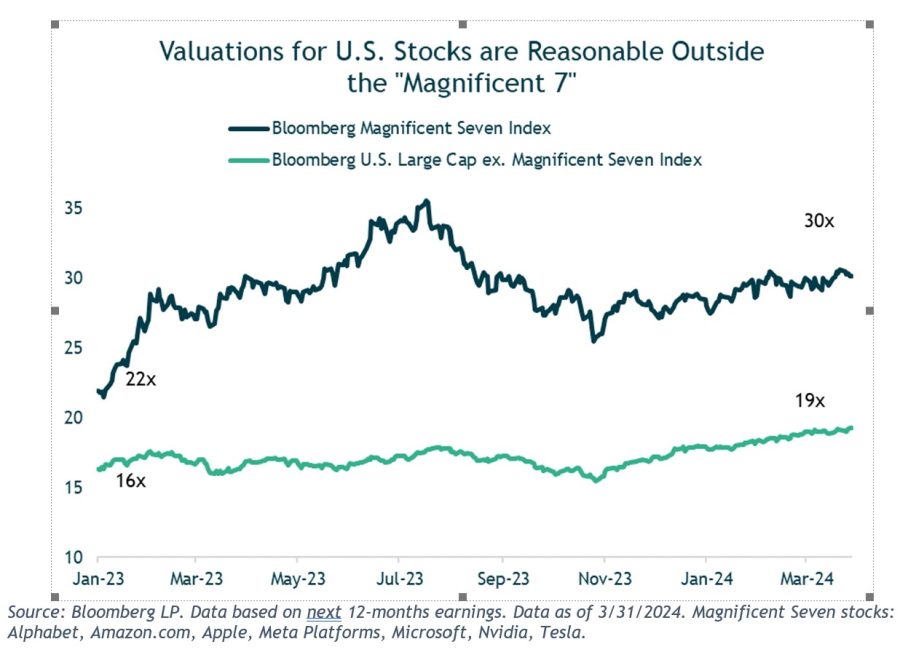

Source: Bloomberg LP. Data based on next 12-months earnings. Data as of 3/31/2024. Magnificent Seven stocks: Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, Nvidia, Tesla.

Fixed-income portfolio positioning has not changed much since year-end. I believe that inflation is under control for now, and that short-term interest rates have peaked and will likely decline slightly over the course of the year. For corporate bonds, I do not foresee a near-term risk of a spike in default rates given the still-attractive corporate fundamentals. If long-term rates climb, I’ll look at adding exposure to capture these yields while adding defensive ballast to portfolios.

Closing Thoughts

The U.S. economy currently appears to be in in decent shape. The stock market continues to hit new highs as economic growth continues. There continues to be a high level of concentration in the “Magnificent Seven” stocks, which comprise about a quarter of the value of the S&P 500. In my view this creates relative opportunity in the remaining 493 stocks in the S&P 500, which have not seen valuations so stretched. The possibility of a recession isn’t off the table by any means, but if it does happen the timing is likely pushed back until late this year or 2025.

As I look ahead, I anticipate there will be pockets of choppiness given headline risks related to Fed policy, geopolitical events such as the ongoing wars in Europe and the Middle East, and the upcoming U.S. presidential election (election years have historically been more volatile for the equity markets). In anticipation, I am prepared to be opportunistic and take advantage of any attractive risk/reward opportunities that arise.

Thank you for your continued trust and confidence.

—Jeff (4/10/2024)

Certain material in this work is proprietary to and copyrighted by iM Global Partner Fund Management, LLC and is used by Bogue Asset Management LLC with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.

Bogue Asset Management LLC’s Investment Newsletter

rket Recap

In the first three months of 2024, the U.S. economy remained resilient despite short-term interest rates sitting near 20-year highs. Noteworthy in the quarter was the continuing robustness in the labor market, stronger-than-anticipated corporate earnings, and a convergence of market participants’ aggressive forecast of rate cuts with the Fed’s own projections. Retail sales pulled back, but the trend remains positive.

These factors provided a supportive backdrop for stocks. The S&P 500 Index continued to reach new highs throughout the quarter, gaining 10.6% in the three-month period. Large-cap U.S. stocks (S&P 500 Index) outperformed small-cap U.S. stocks (Russell 2000 Index), and growth stocks (Russell 1000 Growth) again beat value stocks (Russell 1000 Value).

Developed International and emerging-market stocks also posted gains but did not keep pace with the U.S. market. Developed International stocks (MSCI EAFE) gained 5.8%, while emerging-market stocks (MSCI EM Index) posted a 2.4% return.

Bond returns were mixed as the benchmark 10-year Treasury yield rose from 3.88% to 4.20%, with market expectations for rate cuts tempered in terms of timing and magnitude. In this rising-yield environment, the more interest-rate sensitive Bloomberg U.S. Aggregate Bond Index declined 0.8%. Credit performed relatively well in the quarter, as high-yield bonds (ICE BofA High Yield Index) were up nearly 1.5%.

Turning to Alternatives, Managed Futures (SG Trend Index) had a strong first quarter, gaining 12.2%, keeping pace with the S&P 500 Index (+10.6%) and handily beating the Bloomberg Aggregate Bond Index (-0.8%). This is a reminder that managed futures strategies aren’t just negatively correlated to the stock and bond markets but can also produce attractive returns across different market environments.

Investment Outlook and Portfolio Positioning

The U.S. economy has continued to prove resilient despite the Fed maintaining a higher level of interest rates for longer than most expected. A main driver of this better-than-expected economic growth has been the continued strength of the U.S. consumer. The combination of robust job gains and steady real income growth has allowed consumers to continue spending despite higher rates. The strong consumer has also benefited corporate earnings. And after a decade of near-zero interest rates, companies are generally well positioned financially with balance sheets that are healthier than they have been in past tightening cycles.

Inflation (CPI) has declined meaningfully over the past year, falling from 6% to just over 3%, though still above the Fed’s long-term target of 2%. My expectation is that inflation will continue to trend lower over time, due in large part to shelter costs, which I expect to moderate.

Source: Bloomberg. Data as of 3/31/2024.

With the steady decline in inflation, I believe Fed policy has crept into borderline restrictive territory. The chart above shows the Yield Curve (10-year minus 1-year maturity, blue line), alongside the real fed funds rate (i.e., fed funds rate net of inflation, green line). Going back to 1960, an inverted curve combined with a sharply higher real fed funds rate has preceded a recession (gray bar). In the most recent cycle, however, we can see that while the yield curve has been inverted since July 2022, Fed policy has been very accommodative for most of that time, i.e., the real Fed Funds rates were sharply negative when the curve first inverted. It’s only more recently that Fed policy has started to move toward restrictive levels due to the combination of a higher fed funds rate and falling inflation. Simply put – to the extent that inflation continues to fall, and the Fed keeps rates unchanged, monetary policy will become proportionately more restrictive, and could reach a level that significantly slows the economy.

Economic growth in and of itself does not cause inflation, and ongoing modest economic growth is not a reason for the Fed to avoid cutting rates. However, persistent growth of around 2% does make it difficult to foresee aggressive rate cuts, and I’ve seen this reflected in the market’s expectations for the Fed Funds rate during the quarter. In the chart above, we see that at the beginning of the year, the market was anticipating six to seven rate cuts (shown in blue). But as of the end of March, the market’s expectations (show in green) have tempered, and the consensus is for three rate cuts bringing the top end of the Fed Funds range to 4.75% at the end of 2024.

I am currently in line with consensus expectations that the Fed will cut by 25bps in June, with two more cuts later in the year. With inflation still running slightly hot the Fed has to balance cutting too early and potentially causing a second wave of inflation, versus waiting too long and putting pressure on the consumer and the economy. What the Fed ultimately decides will depend on the economic data that unfolds.

For now, U.S. economic data seems supportive of growth, not contraction. If the Fed is able to engineer a ‘soft landing’ of the U.S. economy with inflation converging to 2% and growth continuing, they can incrementally lower rates and ensure that policy does not become too restrictive. If a recession does occur later this year, the Fed will have the ability to swiftly and meaningfully cut rates given current levels.

Source: Bloomberg LP. Data based on next 12-months earnings. Data as of 3/31/2024. Magnificent Seven stocks: Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, Nvidia, Tesla.

Fixed-income portfolio positioning has not changed much since year-end. I believe that inflation is under control for now, and that short-term interest rates have peaked and will likely decline slightly over the course of the year. For corporate bonds, I do not foresee a near-term risk of a spike in default rates given the still-attractive corporate fundamentals. If long-term rates climb, I’ll look at adding exposure to capture these yields while adding defensive ballast to portfolios.

Closing Thoughts

The U.S. economy currently appears to be in in decent shape. The stock market continues to hit new highs as economic growth continues. There continues to be a high level of concentration in the “Magnificent Seven” stocks, which comprise about a quarter of the value of the S&P 500. In my view this creates relative opportunity in the remaining 493 stocks in the S&P 500, which have not seen valuations so stretched. The possibility of a recession isn’t off the table by any means, but if it does happen the timing is likely pushed back until late this year or 2025.

As I look ahead, I anticipate there will be pockets of choppiness given headline risks related to Fed policy, geopolitical events such as the ongoing wars in Europe and the Middle East, and the upcoming U.S. presidential election (election years have historically been more volatile for the equity markets). In anticipation, I am prepared to be opportunistic and take advantage of any attractive risk/reward opportunities that arise.

Thank you for your continued trust and confidence.

—Jeff (4/10/2024)

Certain material in this work is proprietary to and copyrighted by iM Global Partner Fund Management, LLC and is used by Bogue Asset Management LLC with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.

Bogue Asset Management LLC’s Investment Newsletter