Market Recap

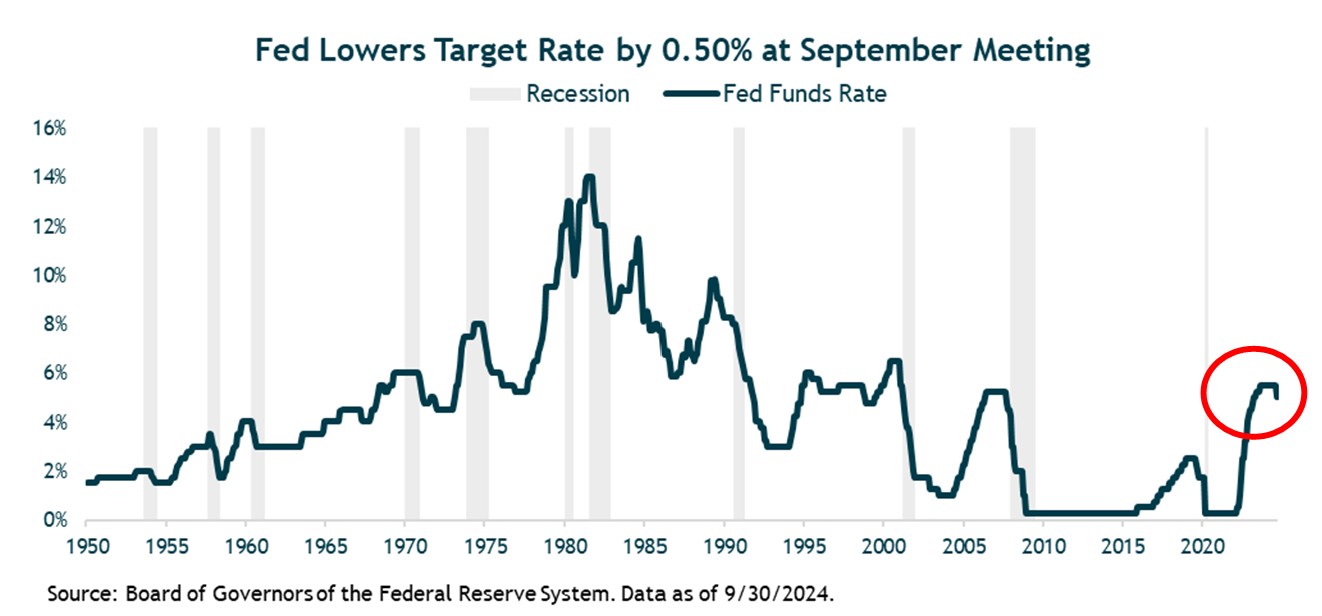

It was far from a quiet summer for the financial markets, which have been volatile as investors parsed through economic data attempting to gauge whether the economy will slow, and how much the Federal Reserve would need to lower interest rates to prevent a recession. Toward the end of the quarter, the Fed opted for a bold start to its shift in policy, reducing rates by a half percentage point. This was the first cut since 2020, and Fed Chair Jerome Powell said the larger-than-average cut was intended to show the Fed’s commitment to “maintaining my economy’s strength” in the face a slowdown in the labor market. Year to date, the economy has proven resilient thanks to strong consumer spending, lower inflation, and healthy corporate earnings.

Despite the volatility, the stock market reached new highs with the S&P 500 gaining 5.9% in the third quarter, pushing its year-to-date return to 22.1%. Notably, there was a rotation out of large-cap growth tech stocks and into a broader range of sectors and styles. The Nasdaq, which led the market higher in the first half of the year, gained 2.8% but lagged other benchmarks in the quarter. Large-cap value (Russell 1000 Value) gained 9.4% and outperformed large-cap growth’s (Russell 1000 Growth) 3.2% gain, and small-caps (Russell 2000) rose 9.3% outpacing large-caps’ (Russell 1000) 6.1% gain. The equal-weighted S&P 500 index (up 9.6%) easily outperformed the cap-weighted S&P 500 during the quarter. At the sector level, traditional defensive sectors were by far the big winners, with utilities, real estate, and consumer staples gaining 19.4%, 17.2%, and 9.0%, respectively.

Outside of the U.S., developed international stocks (MSCI EAFE) gained 7.3%, finishing ahead of domestic stocks in the three-month period. Emerging markets stocks (MSCI EM Index) were relatively quiet for most of the quarter but rose sharply in the last week of the period after China announced their boldest stimulus in years in an attempt to boost their ailing economy. Emerging-markets stock finished the quarter up 8.7% thanks to a 23.5% gain for China during the month of September.

Within the bond markets, returns were positive across most fixed-income segments. The benchmark 10-year Treasury yield declined from 4.36% to 3.81% amid lower inflation and recession concerns. In this environment, the Bloomberg U.S. Aggregate Bond Index gained 5.0% and credit performed well as high-yield bonds (ICE BofA Merrill Lynch High Yield Index) gained 5.5% in the quarter.

Overall, domestic economic and corporate fundamentals remained relatively healthy in the quarter, although rich valuations remain a risk. Looking ahead, the expectation is that the Fed will continue to cut rates this year and next in an effort to guide the economy to a soft landing and avoid a recession.

Investment Outlook and Portfolio Positioning

The Fed’s half-point rate cut in September came after one of the most rapid series of hikes in history that were an effort to combat the highest level of inflation since the early 1980s. Fed Chairman Powell said this larger-than-usual half-percentage-point reduction—rather than 25 basis points—demonstrates the Fed’s commitment to its dual mandate of maintaining a strong job market while keeping inflation in check; balancing these two goals helps ensure a healthy economy. Powell emphasized that the recent cut was a “recalibration” of policy, bringing it in line with the current conditions and ensuring the Fed does not “get behind the curve” in normalizing rates.

The question now is the pace of cuts going forward. According to the Fed’s so-called “dot plot,” which indicates where various members of the Federal Reserve expect the fed funds rate to be over the next few years, the Fed expects another 150 basis points of cuts by the end of 2025, and more modest cuts in 2026. As is typical, the farther the outlook, the wider the range of estimates, i.e., there is less consensus on rate cuts for 2025 and 2026. Powell emphasized that the Fed remains “data dependent,” meaning that any future policy decision will be based on economic data, and he was reluctant to commit to any level of cuts saying decisions will be taken “meeting by meeting.”

Overall, economic data remains generally healthy. For example, real GDP for the second quarter was 3.0% and the estimate for the third quarter (according to the Atlanta Fed) is currently 2.5%. Meanwhile, inflation continues to moderate, corporate earnings remain relatively strong, corporate defaults remain low, consumers (and the government) continue to spend, and interest rates are heading lower albeit at a questionable pace. My base case view is that a soft landing is the most likely outcome for the U.S. economy and that current conditions should be positive for both bonds and stocks, although I expect the pace of gains to slow.

I believe the Fed’s recent shift puts us at a turning point in the fixed-income market, and the more accommodative stance will start a new chapter for bonds. As the Fed lowers short term rates, yields will move lower and reinvestment risk comes into play for short-term instruments. Investors will increasingly start to look for higher returns elsewhere.

In my portfolios, I have meaningful exposure to core bonds which will act as ballast in the event of a recession or traditional “flight-to-safety” market shock. Importantly, I do feel that I am not “stretching” for yield, i.e., taking on excess risk to achieve attractive returns. Many of my exposures are investment-grade or are conservatively positioned within the high-yield space. As always, I’m weighing a range of shorter-term risk scenarios against each asset’s medium- and longer-term return potential and portfolio diversification benefits assuming different macro environments (inflation/disinflation, growth/stagnation).

Stocks have posted one of the strongest year-to-date returns through September since the 1990s, with the majority of S&P 500 return due to expanding valuations. While it is normal for short-term equity returns to be driven by valuation expansion or contraction, I believe that earnings growth is the more reliable driver of long-term returns. With valuations now near historic highs, earnings growth will need to do the heavy lifting in order for investors to realize similarly strong returns as they have in recent years. While it is not out of the realm of possibilities, such an outcome will be harder to come by given historically high profit margins and valuations.

Within my U.S. equity allocation, I remain balanced across my style and market cap exposures. I remain committed to U.S. larger-cap value stocks and U.S. smaller-cap stocks based on my belief the equity market rally would broaden out beyond large-cap growth tech stocks (i.e., the “Magnificent Seven”). The rotation out of technology into a broader range of sectors and styles was evident in the third quarter and I believe there is more room for it to run. Similarly, my analysis continues to suggest attractive long-term return potential for foreign stocks given their attractive valuations relative to U.S. stocks.

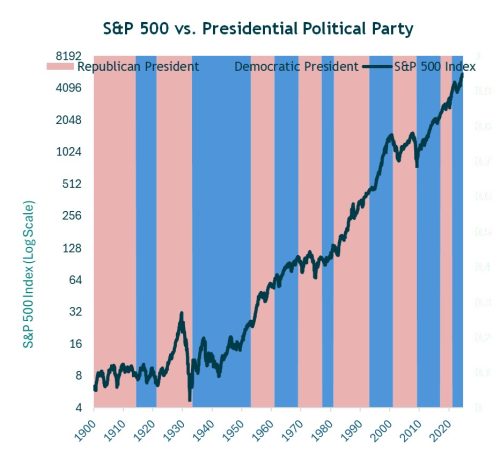

With the U.S. presidential election one month away, I want to reiterate my long-held view that portfolio positioning should be guided by an analysis of longer-term risks and rewards, not election outcomes. I recognize that it’s natural for investors on both sides of the aisle—especially in today’s polarized environment—to believe that an election outcome could have a big impact on the financial markets. This hypothesis, however, is not supported by the historical data and I provide some evidence below that stocks have historically trended higher regardless of the political party of the President.

Ultimately, the market is driven by economic fundamentals, such as the fed funds rates, corporate earnings, valuations, fiscal imbalances, interest rates, inflation expectations, among other factors. Undoubtedly, headlines will influence short-term market fluctuations but longer-term, fundamentals are what drive market performance. My intention is not to minimize the significance of the election, but to point out that the gears of the economy are not overhauled based on an election outcome.

Ultimately, the market is driven by economic fundamentals, such as the fed funds rates, corporate earnings, valuations, fiscal imbalances, interest rates, inflation expectations, among other factors. Undoubtedly, headlines will influence short-term market fluctuations but longer-term, fundamentals are what drive market performance. My intention is not to minimize the significance of the election, but to point out that the gears of the economy are not overhauled based on an election outcome.

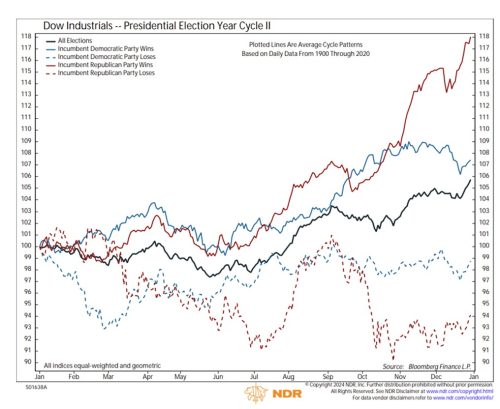

As for market performance around elections, there have been elections that resulted in stock market volatility and declines, notably when incumbents lose (a result that begs the question of whether a bad economic backdrop is what led the incumbent to lose). While technically there is no incumbent in this election, markets typically see a strong rebound in the year following any post-election declines. This shows that historically, elections have not had a meaningful or long-lasting effect on investment performance. That means investors are wise to remain focused on the longer-term drivers of markets and even be prepared to take advantage of any post-election market declines.

As for market performance around elections, there have been elections that resulted in stock market volatility and declines, notably when incumbents lose (a result that begs the question of whether a bad economic backdrop is what led the incumbent to lose). While technically there is no incumbent in this election, markets typically see a strong rebound in the year following any post-election declines. This shows that historically, elections have not had a meaningful or long-lasting effect on investment performance. That means investors are wise to remain focused on the longer-term drivers of markets and even be prepared to take advantage of any post-election market declines.

Closing Thoughts

I remain cautiously optimistic about the current investment landscape. While there are promising signs in the economy, I am also acutely aware of the potential risks that could impact market stability. My focus will continue to be on identifying opportunities to improve long-term returns in line with the risk targets for the portfolios I manage. By staying disciplined and opportunistic, I aim to navigate the complexities of the market and position my investments for long-term success.

I thank you for your continued confidence and trust.

—Jeff (10/08/2024)

Certain material in this work is proprietary to and copyrighted by iM Global Partner Fund Management, LLC and is used by Bogue Asset Management LLC with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.