Market Recap

The U.S. economy and the stock market proved much stronger than many had anticipated in 2024. The S&P 500 Index marched higher throughout the year, finishing up 25%, while notching 57 new all-time highs, the sixth most since 1928, and finishing with consecutive annual gains of over 20% for the first time since the late 1990’s.

The robust gains in U.S. stocks were driven by a healthy U.S. economy, moderating inflation, and widely expected rate cuts from the Federal Reserve. Of course, enthusiasm around artificial intelligence (AI) played a meaningful role, as companies associated with the theme, namely Nvidia and Broadcom, were the main contributors to this year’s stellar returns. Within the U.S. stock market, Large Cap Growth stocks (Russell 1000 Growth) once again led the charge ending the year positive 33%, outperforming Larger-Cap Value Stocks (Russell 1000 Value) and Smaller-Cap Stocks (Russell 2000) which ended the year up 14.4% and 11.5% respectively.

Overseas, returns were not nearly as strong. Developed international stocks (MSCI EAFE) posted a modest 3.8% gain. Calendar-year returns for most foreign markets were dragged down by fourth-quarter losses following the Trump presidential victory, which sparked fears of a widespread economic slowdown due to tariff risks and a stronger U.S. dollar. Emerging markets stocks (MSCI EM Index) had a volatile year, finishing the year up 7.5%. Much of that volatility can be attributed to China. The Chinese stock market (MSCI China Index) had a strong year (up 19.4%) but it was tumultuous, marked by significant swings in investor sentiment.

Within the bond markets, calendar-year returns were mixed across fixed-income segments. The benchmark 10-year Treasury yield experienced significant volatility throughout the year amid concerns around inflation, interest rates, and the impact of potential tariffs under the Trump administration. After starting the year with a yield of 3.88%, the 10-year Treasury ended the year higher at 4.58%. Against this backdrop, the interest-rate sensitive Bloomberg U.S. Aggregate Bond Index was slightly positive at 1.3%. Conversely, short-term and credit-sensitive sectors of the bond market performed well during the year. The Bloomberg Short-Term Treasury Index rose 5.3%, and high-yield bonds (ICE BofA Merrill Lynch High Yield Index) were up 8.2% for the year.

Portfolio Performance and Key Performance Drivers

For the year, my portfolios delivered solid absolute returns across the range of risk profiles, though they did slightly trail their portfolio benchmarks. Performance was driven by a full strategic weighting to stocks. After a strong showing in 2023, U.S. larger-cap blend and U.S. larger-cap value were a headwind to performance this year as they failed to keep pace with the tech heavy S&P 500 index.

Investment Outlook and Portfolio Positioning

Looking ahead to 2025, my base-case is that the U.S economy will continue to grow, albeit slower, with a low probability of recession. This should be a supportive backdrop for both bonds and stocks, although I expect the pace of gains to slow. I continue to think it’s likely that the market will broaden out beyond large-cap growth stocks to include small and mid-caps and non-tech sectors of the market.

As of year-end, my portfolios have a full strategic weighting to stocks, and I remain diversified across geographies, including the U.S., developed international, and emerging markets. In fixed-income I am not “stretching” for yield, i.e., taking on excess risk to achieve attractive returns. Many of my exposures positioned between the high credit quality and the high-yield territory of the bond market. As always, I am weighing a range of shorter-term risk scenarios against each asset’s medium- and longer-term return potential and portfolio diversification benefits assuming different macro environments (inflation/disinflation, growth/stagnation).

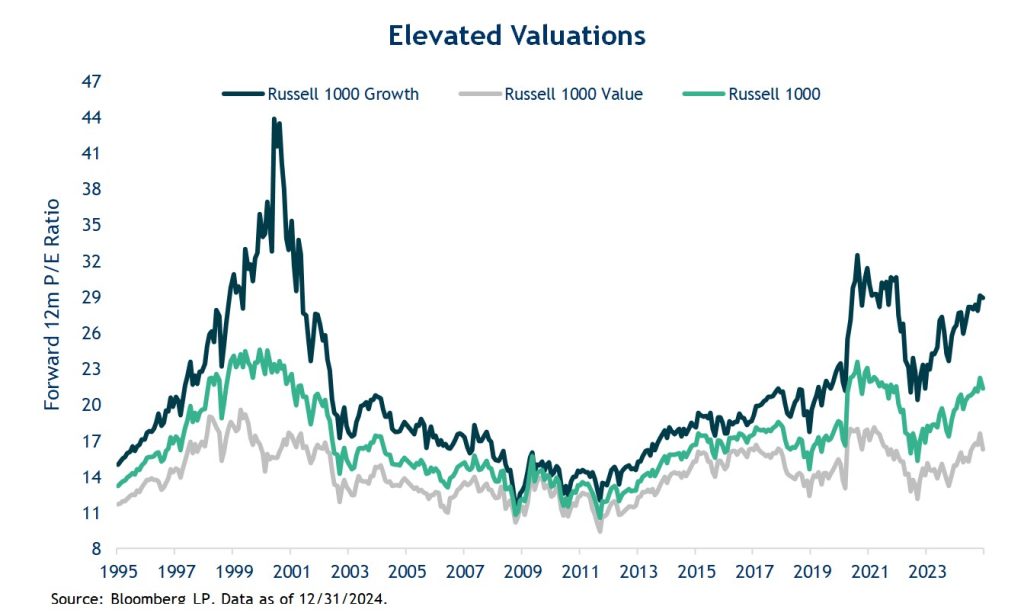

While my economic outlook is generally positive, there are plenty of risks. For starters, following two consecutive years of strong returns for U.S. stocks, valuations are expensive and reflect a significant amount of investor optimism (see chart below). Current valuation levels—particularly for large-cap growth stocks—suggest that there is less room for upside, and there is more downside risk if expectations are not met.

Another consideration is a high level of concentration in the S&P’s top-weighted stocks, which could magnify volatility if any of these companies disappoint. As shown in the chart to the left, the weight of top-10 stocks in the S&P 500 index have reached an all-time high at nearly 39%. The often-quoted Magnificent 7 stocks, generated returns of nearly 70% last year while the remaining 493 stocks clocked in with a 16% return (a respectable figure to be sure, but well behind the Mag-7). The strong performance of large-cap growth stocks in recent years has resulted in one of the most concentrated stock markets on record.

Another consideration is a high level of concentration in the S&P’s top-weighted stocks, which could magnify volatility if any of these companies disappoint. As shown in the chart to the left, the weight of top-10 stocks in the S&P 500 index have reached an all-time high at nearly 39%. The often-quoted Magnificent 7 stocks, generated returns of nearly 70% last year while the remaining 493 stocks clocked in with a 16% return (a respectable figure to be sure, but well behind the Mag-7). The strong performance of large-cap growth stocks in recent years has resulted in one of the most concentrated stock markets on record.

While this narrow market leadership could persist for some time, the generals cannot lead the market higher into perpetuity. The infantry must join the battle for a healthy bull market to continue. Otherwise, failure of a few companies to meet extremely optimistic expectations will drag down market cap weighted indexes (like the S&P 500).

Outside of expensive starting valuations and market concentration, there are the usual suspects that could cause market volatility, including inflation, monetary policy, and uncertainty surrounding incoming President Elect Donald Trump’s fiscal and global trade policy. Investors should be prepared to weather occasional storms in 2025.

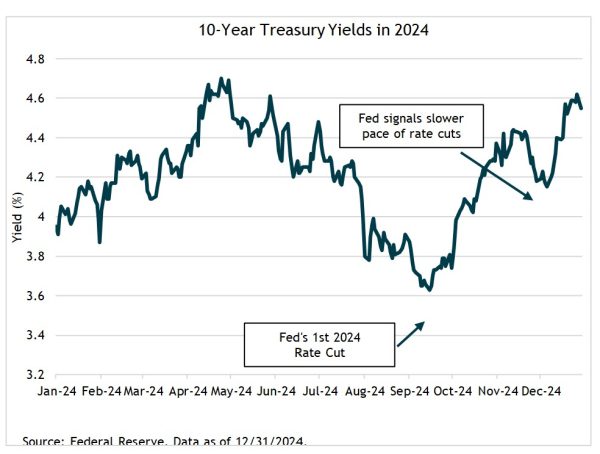

Within the bond markets, investors remain hyper-focused on every economic data release, ranging from inflation and employment reports to GDP growth and consumer strength. Each data point has been heavily scrutinized for its potential impact on central bank policy, driving heightened volatility as investors attempt to project the likelihood of interest-rate changes and the implications on returns. Investor guesswork has led to a very volatile year for the 10-year U.S. Treasury bond, reflecting the market’s sensitivity to economic conditions in an uncertain environment.

In the first three months of the year, inflation pressures proved persistent, prompting the Fed to keep interest rates elevated. But as the year progressed, inflation began to trend lower, and the Fed delivered its first rate cut in September. The September cut was significant for two reasons. It was the first cut in over four years, and it was a more aggressive 50 basis point reduction, compared to the typical 25 bps cut. This was followed by a 25 basis-point reduction in November, and another widely expected 25 basis-point cut in mid-December, the final Fed meeting of the year.=

Although the December cut was expected, the Fed added a bit of a twist, and the market did not like the news. Specifically, the Fed showed a renewed concern over slowing disinflation momentum. The Fed’s median inflation estimates, as measured by core Personal Consumption Expenditures (PCE), for 2025 and 2026 increased from 2.2% to 2.5% and 2.0% to 2.2%, respectively. The following day, stocks fell sharply, and long-term bond yields increased. In fact, since the Fed started cutting rates in mid-September, interest rates have increased by roughly 100 basis points (see below).

Looking ahead to 2025, the U.S. bond market is stuck between the Fed’s plans to cut interest rates (to some degree) and the risk of higher inflation and increasing federal deficits. As was the case in 2024, I think 2025 will be another bumpy ride for fixed-income.

Looking ahead to 2025, the U.S. bond market is stuck between the Fed’s plans to cut interest rates (to some degree) and the risk of higher inflation and increasing federal deficits. As was the case in 2024, I think 2025 will be another bumpy ride for fixed-income.

As mentioned above, there can be a wide range of economic forecasts even within the Fed, despite its extensive resources, highly skilled staff, and a wealth of theoretical and empirical models at its disposal. Therefore, it should come as no surprise that I do not hang my hat on the Fed, and I view them as any other forecaster: imperfect.

My investment approach attempts to navigate uncertainty rather than trying to predict precise outcomes. Instead of relying on pinpoint forecasts, I focus on understanding a range of possible scenarios and analyzing their potential implications for my portfolios. By evaluating risks and opportunities across different economic and market conditions, my goal is to stack the odds in our favor, even in complex and volatile environments.

Closing Thoughts

I remain cautiously optimistic as we enter 2025. While there are promising signs of growth and resilience in the economy, I am also acutely aware of the potential risks that could negatively impact market stability. For example, the U.S. economy will likely downshift into a slower gear. I do not believe this slower growth, in and of itself, will cause a recession, but it does leave the economy more vulnerable to shocks, including significant policy changes from the new administration. Furthermore, the past two years of strong returns leaves valuations elevated. My focus will continue to be on identifying opportunities to improve long-term returns while being vigilant of the risks I am taking. By staying disciplined and opportunistic, I aim to navigate the complexities of the market and position investments for long-term success. As always, I appreciate your trust and wish you and yours a wonderful new year.

—Jeff (1/9/2025)

Certain material in this work is proprietary to and copyrighted by iM Global Partner Fund Management, LLC and is used by Bogue Asset Management LLC with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.